Social Security Digest (12/16/04)

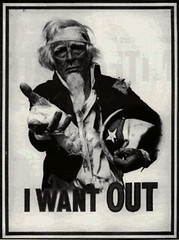

The great debate on Social Security is raging back and forth, and now Bush has fired his loudest shot over the heads of the bleeding hearts who want to see a safety net left in place. Below is a selection of some of the best and most concise readings on the problem from a liberal standpoint that I have seen so far.

First, an omnibus source of info in itself, check out The Social Security Networkwebsite, sponsored by The Century Foundation.

Krugman, with a general overview of why the arguments for change are false

Josh Marshall who warns us away from being sucked into making the financial risk/Wall Street argument and reminds us what S.S. was for in the first place: a safety net for old age that could not be touched by hard luck or hard times:

“This isn't about financing. It's about whether Americans get to keep Social Security, a program of guaranteed retirement insurance, which unlike the other key elements of a good retirement plan -- investments and pensions -- cannot be taken away.”Michael Kinsley, on the contradictions inherent in the argument for change.

Quiddity with graphics

The Center for Economic and Policy Research, with a clear, simple, scientific analysis, with charts for clarification. CEPR's report makes these points:

1. Social Security is Financially Sound

2. President Bush's Social Security Cuts Would Be Large

3. Imaginary Stock Returns Don't Offset Real Benefit Cuts

4. Social Security is Extremely Efficient, Private Accounts Are Wasteful

5. Social Security Pays the Most to Those Who Need it Most

6. The Projected Shortfall is No Larger Than What We Have Seen In Past Decades

7. Young Workers Will Still See Much Higher Wages If Taxes Are Increased

8. The Bush Proposal Phases Out Social Security as We Know It

Update: Krugman checks in with a nod to The Century Foundation, referenced in the post above

Screw the Help (1/11/05)

Do people still know what it's like to spend a long day at work, every muscle aching from the job you're doing, and then to go home and collapse in a heap to try and rest up so you can make it through tomorrow, without the energy left to do much of anything else? Well you can be sure some people do.

But they aren't likely to be the ones sitting in the capitol pulling the strings on Social Security. I am sick to death of people without a clue as to what it's like working hard, underpaid physical labor, who sit around making pronouncements about what should be done with our money. When is the last time someone who worked with their hands went from the worksite to the House or Senate? When is the last time they sat on a thinktank or journalists' roundtable of "experts" to hold forth on what should be done with the little peoples' retirement future?

There's been a lot of discussion about the future of Social Security, but much of it betrays a blindness (or callousness) as to what many of the suggestions, if implemented, would mean in the real world. Many of those who would gut and destroy the system have no worries for their own futures, and the existence of that check each month is not going to make much difference to them either way. One of the worst suggestions being seriously considered by Republicans and open to compromise by the Democrats is the possibility of raising the retirement age to bring it in line with (let's face it, because they're the highest) white female longevity averages. But who really looks at what impact this could have?

Over at Brad DeLong's site, he quotes Irwin Stelzer of the Weekly Standard as having "some smart things to say about Social Security". "Smart" meaning, in part, that:

"Surely, extending the retirement age to reflect current longevity expectations should also be on the table."Surely, no reasonable person with a 6 figure income, a portfolio to die for, and plenty of investments squirreled away offshore, anyway.

This was my response in DeLong's comments section:

"As long as the subject of raising the retirement age keeps coming up, let's talk about what that would mean for people whose work consists of hard physical labor, often with physical side effects that can be debilitating over a long period of time.The question is now: Who will stand up for these people? Who is left to be their voice in the media, the government, and on the street now that the Democrats have abandoned human rights and justice for the sexy language of "moral values", and the Republican party has safely made the final transition to a completely plutocratic vehicle for the rich and powerful?

I never hear anyone discussing this, probably because the people debating it and most likely to write or influence the law on it themselves work mostly in offices where the hardest labor they encounter may be hauling a couple reams of paper, and the worst disabling injury may be carpal tunnel syndrome.

Getting to the average retirement age in one piece and still working can be a challenge to people who work in meat-packing plants, construction, domestic service, and similar work.

Many of these people are praying every day that their bodies will hold out. To move the retirement age even farther away from them is not only cruel, it is symptomatic of how alienated the governing and academic classes are from the people who create and support the infrastructures of their cushioned lives."

Hialeah Dreaming (1/15/05)

Yesterday, slacktivist's Fred Clark examined a piece written by Jonathan Rauch for the National Journal in which Rauch posits that the ultimate purpose behind the Repulican push to alter Social security is to re-engineer the public's perception of the duties of government and wean it from expecting social assistance for events which can be forseen.

Fred interprets Rauch as speaking for himself in calling SS "welfare", and then goes on to make a good case for why it isn't:

"Franklin D. Roosevelt was adamant, in creating Social Security, that the system was not welfare. To avoid that perception, or that accusation, he insisted that the flat-rate payroll taxes that fund the program be capped. Most Americans don't realize that there's a cap on payroll taxes because most Americans don't make more than $87,900 a year. Those who do, however, get a nice little tax break on their 87,901st dollar, and on every penny they earn beyond that... Well, if you can't beat 'em, join 'em. You want to pretend it's welfare? Fine, let's pretend it's welfare. That means eliminating the cap on payroll taxes. And while we're at it, since this is a "welfare" program we're talking about now, let's keep in place the limit on new benefits for salary above that cap. This would be a fundamental change -- from social insurance to social welfare. And it would likely create a boom in creative new forms of non-wage (and thus nontaxed) income. But the resulting infusion of revenue would ensure the complete solvency of the program until long after the last-living baby boom widow was buried."But after reading the NJ article, I'm not sure whether Rauch was agreeing with conservatives that it is a form of welfare, or whether he was putting that forth as part of an example of conservative argument against excessive interference with public life.

That doesn't mean there isn't plenty of fodder for exasperation in it, most especially regarding the comforting myths about class and human behavior with which it enfolds itself. These are assumptions that we see parroted in the press and on websites everyday in statements by administration officials, "experts" and opinion-hurlers, until sheer repetition gives them the sheen of truth. For instance:

That investment will naturally give higher returns than SS if one accepts the increased risks.

Well, sure, if you put your money into volatile stocks that can also offer the potential for bankruptcy if you guess wrong. If you want to safeguard your old age with stocks equivalent in safety to SS, you're going to find that they pay just about the same as SS, plodding along unsexily, day after day. But those safe bets are a lot less common than they used to be, as stocks get wilder and wilder.

That we need to encourage a "culture of saving and personal responsibility", improve work habits and reduce crime, and that SS privatization will do it.

Guess what? Crime is down, has been going down, and shows every indication of continuing to go down. In addition, Americans are working more hours, are more productive, and have less leisure than citizens of any other developed nation. They are kept at the grindstone by businesses that refuse to hire needed additional workers in order to save on wages and benefits, then overwork their existing workforces to make up for it. This is the reason business pushed so hard last year for a redefinition of the "supervisory" employee, so that rank and file workers could be made to work overtime without receiving the overtime pay they once did. As for class warfare, what do they know about it? Someone dares mention that the policies of the administration have consistently favored the wealthy and attacked the weakest among us, and the right-wing, in its best Orwellian language, boo-hoos that it's "class warfare". Someone once cited a peasant rebellion in Britain against a local lord that culminated in the rape and dismemberment of his wife and children in front of his eyes, after which he was roasted alive on a spit. That, said he, was class warfare. The fact that so many of us have sat slack-jawed in front of the television watching this parade of outrages every night and not lifted one finger to redress them, even on our own behalf, is the amazing thing, and the only thing that prevents any real class warfare from occuring.

That involvement of the masses in the ownership of their own investment funds will make them more like the average Wall Street habituee, and create millions more Republican-prone voters.

Oh, yes. And we'll just be rife with buying and selling, and merging and trading, and then we'll all hold hands and sing as the next right-wing extremist mounts the presidential throne. Hmmm. Old ladies with a pittance in fast-dwindling blue chips will suddenly feel solidarity with Warren Buffett? When's the last time these guys had to stretch a paycheck from one week to the next, or weighed the merits of spending more on one kind of cereal over another based on how long it would last or how many it would feed? How many leave bills or utilities partially- or unpaid from month to month to pay other, more pressing debts? How many haven't seen a movie or bought new clothes for months because the money just wasn't there? And how many put off the doctor, or dentist, because there are more important things to buy, and they'll just wait and see if the pain goes away by itself? And they think these people, because a change in SS frees up $100-$200 a month, are going to sink the extra into a pie-in-the-sky someday crapshoot? And even if they did, who is going to teach them how? The government itself, that can't even understand or control the consequences of its own economic decisions?

It would be wonderful if the social engineers and media loudmouths that hold forth so glibly on other people's lives would step outside and spend a little time living them. But as that isn't going to happen, I have my own proposal for applying their principles for SS change to the rest of the US budget: Let's take, say, the revenue for highways and transportation, and give it to the Secretary of the Treasury, and send him down to Hialeah to see if he can't double the national take before sending it along for disbursement to the states. If he loses, hey, that's what happens when you live in a Darwinian idyll of personal responsiblity.

2 comments:

Dear It's my country too,

I just have a quick question for you but couldn't find an email so had to resort to this. I am a progressive blogger and the owner of the mahablog. Please email me back at barbaraobrien@maacenter.org when you get a chance. Thanks.

Barbara

I already have.

Post a Comment