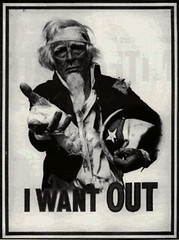

So it goes in the rough-and-tumble new world of bankruptcy court. The bankruptcy process was created decades ago as a way to give ailing businesses a chance to heal and creditors a shot at repayment. Hedge funds and other big investors have transformed it into something else: a money-making venue where, after buying up distressed companies' debt at a deep discount, they can ply their sophisticated trading techniques in quest of profits. The "bankruptcy exchange," some call it.Here's an example in action:

This is perfectly legal, but is raising questions of transparency and fairness as the "distressed debt" investors joust with bankruptcy judges and others over what they must disclose as they trade in and out of a company's debt, even while trying to influence its reorganization.

To some in the bankruptcy bar, the investors' tactics are an affront to a tradition meant to nurse companies back to health and save jobs. At worst, say critics, the involvement of distressed-debt investors can turn a bankruptcy case into an insiders' game, putting at a disadvantage other creditors and even the judge who is trying to guide an outcome that best serves the company and the wide array of those it owes.

"Now what happens is you have very sophisticated people whose primary objective is material gain," says Harvey Miller, a veteran bankruptcy lawyer at Weil, Gotshal & Manges. "You've changed [bankruptcy] from at least the semblance of a rehabilitative approach to a casino approach of 'how do I make more money?'

ION Media Networks was on the cusp of emerging from bankruptcy last November when hedge fund Cyrus Capital Partners, which had proposed a different plan favoring itself, objected at a hearing in federal bankruptcy court in Manhattan.The judge had it right in the first place. How long before these scum start hedging on whether Hospital A loses more patients than Hospital B? Or buying up shares of dead-peasant policies?

Judge James Peck complained that this creditor had bought debt for "cents on the dollar" and then "decided to hijack the bankruptcy case." He wrote that the fund was "using aggressive bankruptcy litigation tactics as a means to gain negotiating leverage or obtain judicial rulings that will enable it to earn outsize returns on its bargain-basement debt purchases at the expense of" senior lenders.

After the reorganization plan was approved, Cyrus asked Judge Peck to delay ION's exit from bankruptcy while the fund appealed. This prompted another rebuke from the judge. "So you're looking at a free shot to continue your terrorism in this case at different levels of the federal system?" he asked, according to a transcript of the hearing.

Cyrus's lawyer responded: "Not at all, your honor, and from my client's perspective we object to the use of terrorism here."

Oh, hell, they already are.