Since then I've seen houses on my own street turn over within a month, at a third again what the previous owner had paid only a year before. I was in awe of where people were getting this kind of money...dropping a half a million without blinking an eye. Even eight years ago we looked at "starter homes" going for $180K, houses too small to squeeze an average family's weekly cheese purchase into, homes so poorly constructed and victims of so many years of poor maintenance and worse decorating that I thought I had been sucked into a time warp and returned to those thrilling days of shitkicker yesteryear, where there was painted tractor tire in every front yard and a zaftig black metal silhouette of a bent-over housewife beside every flower bed. Fast-forward, and houses we thought were overpriced in 1998 re-valued at twice or more what they had sold for. Speculators were buying up local properties and renting them.

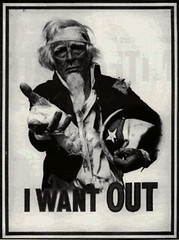

And then came the summer of 2006.

From July 2006:

Today’s real estate market, by the numbers.

Key statistics on real estate markets in Pennsylvania, DC, Northern Virginia, and Suburban Maryland.

The chart below provides a snapshot of key real estate markets within the Corus service area, and shows how the market compares with the same time last year. Here are a few of our observations about these figures:

* In most markets, it takes more than twice as long to sell a home as it did last year.

* In the Delaware Valley, the number of active listings is 50% greater than last year; in the DC area, there are 2 to 3 times as many listings.

* The high inventory level is getting worse. Last month, the number of new listings hitting the market was 2 to 3 times the number of properties that went under contract.

* Home prices have held steady. With only the exception of Loudoun County, VA, average home prices are up between 1% and 11% in each of our markets.

From August 16

Home construction in the U.S. dropped last month to the lowest level in almost two years after higher mortgage rates slowed sales and left builders with bloated inventories.

Housing starts fell 2.5 percent, more than forecast, to an annual rate of 1.795 million, a Commerce Department report showed today. Building permits, a sign of future construction, declined 6.5 percent, the most since September 1999.

The National Association of Home Builders/Wells Fargo's index of builder confidence fell plunged this month to the lowest level in 15 years. The Standard and Poor's 500 Homebuilding Index, made up of five of the largest U.S. builders, has fallen by more than a third this year, the second-worst performance among S&P 500 industry groups.

Horsham, Pennsylvania-based Toll Brothers Inc., the largest U.S. luxury homebuilder, said homebuilding revenue in the quarter ended in July fell for the first time in four years. The company, which will release its earnings on Aug. 22, may report lower profits for the first time since 2002.

"Nervous buyers are canceling contracts for homes already under construction," Robert Toll, the builder's chairman and chief executive officer, said on a conference call with analysts and investors on Aug. 9. The downturn "appears as though it will last for at least six months more, or it could last for two years more."

Homebuyer affordability declined in June to the lowest level since record-keeping began in 1989, according to the National Association of Realtors. The median price kept rising and mortgage rates increased.

From August 19

In Las Vegas, at least three major condo projects backed by high-wattage investors such as George Clooney, Michael Jordan and Ivana Trump have been put on hold. Developers also have deep-sixed major complexes in Philadelphia and Miami.

And then, we have this:

Notable Homes: Villanova, PA (July 2006)

A (very) high end property on the Main LineWords fail me.

This home, currently under construction, is the most expensive home currently listed in Montgomery County, PA.

For Sale: 610 N Spring Mill Rd, Villanova, PA. $12,500,000.

Even in the most expensive areas of the Delaware Valley, we don’t see too many homes in this price range. This new home promises to set a new standard for high end properties in the area. Even if this isn’t exactly in your price range, it’s interesting to see what’s possible.

This home is located on Spring Mill Road in the “Estate District” of the Main Line. It is currently in its early stages of planning and construction. When complete, this home will have approximately 20,000 square feet of living space in 4 acres. It has 7 bedrooms, 9 full baths, and 2 half baths. Amenities include a squash court, tennis court, pool, formal gardens, a multi-car garage. The home also includes a ballroom and screening room.

No comments:

Post a Comment