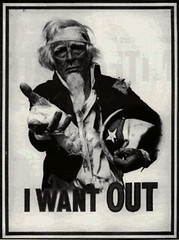

Senator Bob Corker, the Tennessee Republican who is playing a crucial role in bipartisan negotiations over financial regulation, pressed to remove a provision from draft legislation that would have empowered federal authorities to crack down on payday lenders, people involved in the talks said. The industry is politically influential in his home state and a significant contributor to his campaigns, records show.Yes, politically influential, as in "was born and bred in Tennessee and has the whole state by the short hairs":

W. Allan Jones, the jet-setting visitor, went on to found Check Into Cash, the first of the national payday-lending chains. With a knack for marketing, Jones rechristened the transaction Eaton called “check cashing” as “the payday advance.” It was Jones who saw the potential to expand someone else’s business concept into a coast-to-coast empire. Jones saw how payday lending could be to finance what McDonald’s is to food.Corker's BFF Jones has made big inroads with him, as well as with Chris "The People's Friend" Dodd, in trouncing any possible controls over his behemoth:

In the early 1990s, there were fewer than 200 payday lending stores in America; today, there are over 22,000, serving 10 million households each year—a $40 billion industry with more U.S. locations, in fact, than McDonald’s. Today, Jones’s company, based in his hometown of Cleveland, Tennessee, is the second or third largest of its kind.

W. Allan Jones...has been a longtime friend and supporter of Mr. Corker’s...So tiresonely predictable. As is this:

Mr. Jones, his relatives and his employees have given money to Mr. Dodd, Mr. Shelby and other members of the Banking Committee, but have been particularly active donors to Mr. Corker, records show. They have contributed at least $31,000 to his campaigns since 2001, when he was running for mayor of Chattanooga.

In 1999, Mr. Jones and other payday lenders started the Community Financial Services Association to lobby against regulation. The group’s political action committee gave $1,000 to Mr. Corker last year.

Late last month, Mr. Corker pressed Mr. Dodd to scale back substantially the power that the consumer protection agency would have over such companies, according to three people involved in the talks.Typical Dem timidity. We may be in the worst financial state in my lifetime, and citizens may be suffering as never before, but that's no reason to extend unemployment to people who can't find work, or rein in the financial criminals who made them so, and God forbid we put a bit in the teeth of one of the cruelest and most usurious scams on earth. After all, no one in Congress will need to use payday loan centers. They were specifically targeted at the poor, from whom the banks divested themselves years ago:

Mr. Dodd went along, these people said, in an effort to reach a bipartisan deal with Mr. Corker after talks had broken down between Democrats and the committee’s top Republican, Senator Richard C. Shelby of Alabama.

An applicant need only fill out the sheet, show proof of employment and a bank account, and then write a bad check, dated her next payday, for the loan amount plus the fee. (In Tennessee, typical advances range from $50 in cash for a $58.82 check, to $200 for a $230 check.) On that next payday, the customer cashes her paycheck and buys back the check in cash for its face value.Now, that's a system you can get behind, right? Good old American entrepreneurship at work, right? It's a free country, isn't it? Well, then why did these same cats' paws vote for this?

Such is the process in principle, but seldom does it work out that way. When the next payday arrives, most borrowers can’t afford to repay, so they extend the loan until the following payday by paying another finance charge...Like a sharecropping contract, a payday loan essentially becomes a lien against your life, entitling the creditor to a share of your future earnings indefinitely. Even the industry- sponsored research cited on the Check Into Cash website shows that only 25.1 percent of customers use their loans as intended, paying each one off at the end of their next pay period for an entire year. Government studies show even lower rates of customer payoff. North Carolina regulators found that 87 percent of borrowers roll over their loans; Indiana found that approximately 77 percent of its payday loans were rollovers. This is hardly surprising, of course: if your finances are so busted that a doctor visit or car repair puts you in the red, chances are slim that you’ll be able to pay back an entire loan plus interest a few days after taking it out...

Once caught in the cycle, the borrower faces a choice each payday—pay Check Into Cash $30 or pay Check Into Cash $230. Unlike conventional loans, in which the creditor issues the debtor a lump sum to be repaid with interest in installments over time, the largest single transfer in a payday loan goes from debtor to creditor. With payday lending, the “debt trap” is not a figure of speech: the loan is actually structured as a trap.

The John Warner National Defense Authorization Act for Fiscal Year 2007 became law this last October. One small section of this Act, Section 670 under "Subtitle F--Other Matters," gives marching orders to the practices of creditors who prey upon military service members and their dependents. (A "predatory lending practice" is one considered to be "an unfair or abusive loan or credit sale transaction or collection practice.") Among those affected are businesses that offer military personnel deferred deposit transactions--small, short-term loans better known as "payday loans--without regard for their ability to repay and with excessive charges packed into the loan and terms requiring, for example, balloon payments and waiver of legal rights. Loans such as these have proven to be a source of spiraling debt for many military families.Once upon a time, for a minute, they realized how destructive these businesses were to families and communities. But I guess unless you agree to give up your life for stupid illegal wars, you don't rate such protection.

But maybe I'm too harsh. After all, as Obama's people never tire of telling us, it's a "difficult" political environment. Maybe they really are just trying to help out the unemployed the only way they can. You see, joblessness has opened up a whole new set of hunting grounds for Allen and his fellow bottom-feeders. So now Dodd and Corker and Shelby can look forward to the assets of the poor trickling up to them at an even faster rate. What you and I can look forward to, though, is more of the same cowboy capitalism and non-regulation Reagan's Republican party gave us starting in 1981, with willing Democratic abetment. An environment, in fact, that will look an awful lot like the one that allowed this mess to get going in the first place:

From customers in such straits, Allan Jones has amassed a fortune, which in 2005 was valued at half a billion dollars. The profit margins are similar to those in conventional banking, but as with fast food, payday lending derives those profits from innumerable small-value transactions taking place at thousands of outlets. The business works according to the classic logic of deregulation. Profits on loans of a few hundred dollars can be significant only in a regulatory environment in which anything goes. If customers weren’t trapped—if they really paid off their $20 or $30 finance fees at the end of one pay period—payday lending wouldn’t be profitable at all.

No comments:

Post a Comment