Truly. Things like starting up new businesses, injecting capital into existing businesses, and funding R&D work, all of which could give a boost to the employment which we desperately need, right?As the economy continues to recover, many companies are flush with cash. Now they just need a way to spend it — and that may include some deal-making.

The top 50 holders of cash in corporate America have nearly $473 billion in cash on their books, according to data from Thomson Reuters. Among these are seasoned deal-makers like Berkshire Hathaway, Hewlett-Packard and Oracle.

Take, for instance, the Simon Property Group, which added to its reserves over the last year to prepare for acquisitions. In February, the mall operator announced a $10 billion unsolicited takeover bid for General Growth Properties, most of it backed by cash.

As companies exercised caution during the financial crisis, many began socking away cash to help them weather the market turmoil. But bankers argue that having too much cash on hand is wasteful because companies could put it to better use.

To spend cash, companies have several options, including capital expenditures, research and development and share buybacks.

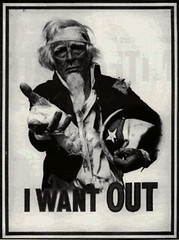

Nah:

But if companies are looking to bolster their growth significantly, mergers are one of the quickest ways to do so.Yes, it's hard to argue with a business strategy that rakes in boffo profits for the predators on the top of the food chain while eliminating all those unsightly laborers at the bottom.

As the markets recover, the percentage of deals that include a stock component will inevitably rise. So far this year, about 17 percent of worldwide merger activity has consisted of cash-only deals, down slightly from 18.3 percent for the same period last year, according to Thomson Reuters.

Even so, bankers say,, it’s hard to argue with the certainty of a cash offer.

They still don't get it, that continuously merging and buying up other companies reduces the number of jobs, creates and propagates more and bigger monopolies, reduces the options left to both sellers and buyers in the market, and works mostly to siphon off money from the bottom 90% for the delectation of the top 10%. Who, BTW, can't spend it fast enough, and so are reduced to creating spectacles to rival the caesars of old Rome.

Actually, the caesars were believed to be descended from gods, and the new caesars are just "doing God's work,"so it all works out.