In the New York Times today, David Leonhardt comes very close to having

an epiphany, at least what passes for epiphany at a news organ addicted to tales of over-the-top weddings and how much house $3 million can buy. Why, he wonders, does the recovery remain so jobless despite a rising GDP, high corporate profits, and a hard-working, efficient workforce?

But beyond these immediate causes, the basic structure of the American economy also seems to be an important factor. This jobless recovery, after all, is the third straight recovery since 1991 to begin with months and months of little job growth.

Why? One obvious possibility is the balance of power between employers and employees.

Yes, he comes close, he's practically sitting on it, but then he backs off like a mule at the edge of the Grand Canyon. Because what he sees there is a truth that clearly scares the bejeezus out of him, as you can tell by his verbal scuttle away from the brink. Unions have withered, he says, courts are business-friendlier, and "many companies can now come much closer to setting the terms of their relationship with employees." But since when was this not mostly true? To work in this country means not only acceding to an employer's schedule and accepting his wages (excepting in cases where unions have forced codification of basic human rights into federal law), but also absorbing a thousand smaller humiliations: random drug tests for jobs that entail no safety issues or probable cause, bullying disguised as supervision, requirements of specific off-the-clock behavior in the name of health insurance cost containment that are reminiscent of the days when single women could not be seen with men on pain of termination. Employers have the power. And employers, especially today, represent the group most responsible for the jobless situation: the wealthy.

But watch his gyrations as he works assiduously to avoid the word and the blame that goes with it. He repeats that favorite koan of supply-side Econ 101, that "only by lifting economic growth will we put people back to work". Yet his own graphic shows that as GDP has risen since 2008, the number of employed continued to plummet, and has now, at best, merely stagnated at an incredibly high level. So whose growth is it we're talking about? Certainly not the unemployed masses, or those lucky enough to find work after a layoff at half their previous wage or worse.

Then he posits that "policy makers could also help the unemployed by spreading economic pain more broadly among the population." He doesn't explain exactly

who this population is that should have some pain, but given that the poor have always felt it, and the middle-class has been having its share for years, it really only leaves one group...who shall remain nameless, thank God, or someone from the Business Section might get his nose out of joint.

He lauds Germany and Canada for averting layoffs by job-sharing and cutting wages and hours, while wondering why Americans, whose average wages have risen faster than inflation since 2007, still retain such high numbers of unemployed. But that "average" wage is skewed by the wages of the top few into irrelevance, if not falsehood. Inflation has been almost extinct, so anything that exceeds it, exceeds it by a pittance. Both Germany and Canada have strong unions and workers whose actual wages are better than those of Americans. And unlike America, in both countries credit never took the place of the real earning increases that a fairer distribution of employer profits would have allowed, so the phenomenon of debt carried by American workers to negate their declining wages did not undermine their economies to the same extent.

He also lauds Germany for its work-sharing program, while ignoring the fact that Germany has had a power-sharing tradition of workers sitting beside management on the boards of its companies since the end of WWII, a tradition specifically engineered by policy-makers from the U.S. In our lifetime power between workers and bosses in Germany has never been the kind of unequal feudal arrangement we have in the U.S. The fact that Germany has performed so well over the decades, and taken so little relative pain since the crash, has a great deal to do with the fact that employees had some control over the natural rapaciousness of the moneyed class, yet Leonhardt has to take a crack at unions in the U.S. anyway:

One problem is that too many labor unions, like the auto industry’s, have been poorly run, hurting companies and, ultimately, workers.

One problem is that unions had nothing at all to do with Detroit's management into oblivion, which occured not once, but twice (first in the 70s. They had nothing to do with management decisions to put allthe eggs into the SUV/truck basket while doing relatively little R&D and long-range planning in preparation for a paradigm shift that anyone who follows the oil business could see coming down the pike for decades. Without the kind of genuine power-sharing inherent in the German approach, unions have relatively little power over a company. They don't set its goals, and they don't make decisions in the boardroom, and those are the kinds of things that really determine whether a company succeeds of fails.

And then he finally goes there:

The list of promising solutions to the jobs slump can go on and on. Reforming the disability insurance system so it does not encourage long-term joblessness would help.

Yes, this idea that the disabled are dragging us into the pit has

gained traction lately, and when you run out of other targets, you have to dig deep to avoid naming the guilty. I would suggest that Leonhardt take some time from his busy day and read Charles Pierce's horror story

"The Era of Big Government Is Over And Marcus Stephens Is Dead", of how that same system, pummeled by lies from Right back in the 90s, murdered a young boy to prove it wasn't allowing the lazy little goldbricker to steal from the coffers of his betters.

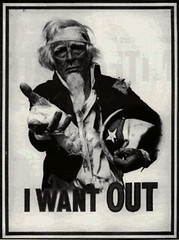

You want things to change? You really have to learn how to name names.