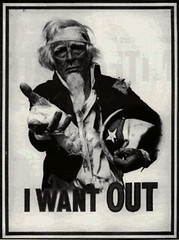

Well, look out, because we can't just be giving money away to the working class while the rich have their noses pushed up against the candy store window. God forbid we bestow a handful of drachmas to the less-well-off and not give the fat cats get even more. This is America, for God's sake:

Lawmakers announced plans earlier this week to attach the tax-credit proposal to a pending bill on the unemployment benefits. The $8,000 tax credit, enacted earlier this year as part of the $787 billion economic stimulus package, is set to expire at the end of November.That's the way. Hold the country's unemployed hostage until you can get more money into the hands of the Quarter-Million Dollar Club. And make sure that they can include the money from the sale of a current home in the bonanza.

The lawmakers want to extend it until April 30. Their proposal would also expand it to allow higher-income Americans and some who already own homes to qualify for the break.

Homebuyers who have lived in their prior residences for at least five years may receive a $6,500 credit under the plan, said Senate Finance Committee Chairman Max Baucus. Also, couples earning as much as $225,000 and individuals as much as $125,000 would qualify for the extended break, Baucus said. That’s up from a $75,000 limit for individuals and $150,000 for couples.

Is there some reason my taxes need to help some rich bastard move on up?

No comments:

Post a Comment