First, let me give you a quick math lesson: I am a supervisory employee with the state. When I retire, in my 60s, with 20 years of service, I will earn the princely sum of about $25,000 a year from my public pension, assuming I still have it after Corbett gets done. Many people I know earn less than me, and will get less when they retire. Even I earn more than the average public employee in my state, so comparing some anomalous local fire chief or some highly-paid but rare regional director to a cashier at Barnes and Noble is like comparing a highly-paid private-sector Vice President to me.

Now imagine that you and your husband have a savings account, and every pay, you both contribute to it. You put in a bit more than he does. But for the last 10 years, unknown to you, you continued to contribute while he refused to do so. He even pulled money out. Since he used this money to pay your bills, you didn't notice that the cost of living was going up beyond what you were earning, and you didn't think to wonder why you could still afford to live on your combined incomes. One day you check the account and--quelle surprise!--there's less than half of what you had in it 10 years ago, and your retirement is just a couple years away. You can't continue to live on what you earn because neither or you has had a raise in 10 years, and your only choice now is to keep working and eat up the rest of your savings. Well, that savings is the pension fund. Your pay checks are the taxes we pay for the services we expect from the government. The raise you didn't get is the tax hike that should have occurred to fund government services, the cost of which were going up just like the cost of everything else. And that rat of a husband stealing your retirement from under your nose is the elected official who bought voter approval by stealing from the public pensions instead of raising taxes as he should have.

My comment on the story linked to above and left at the Times, follows:

Nice hatchet job. Let's cherry-pick the stats on the people getting the best pensions in the private sector instead of the public sector and compare them: payouts from shareholders and taxpayer subsidies and consumers that amount to billions of dollars over the lifetime of a single former CEO hardly compare. But you would object that using such a CEO as an example for the whole private sector, Wal-Mart greeters included, badly skews the argument against pensions for the private sector? Well, no more so than this article does to the public sector.

Further, where is the close examination of the fact that these pensions were deliberately unpaid or underpaid by these governments for years, even during good times, while the employees themselves continued to pay, and increase their contributions, into the fund? Where is the discussion of the cutbacks experienced by public employees in their contracts for the last 10 years even while private business payroll grew, which permanently hurt public employees' pension amounts? Where is the mention of the fact that as the cost of all other things grew, governments and taxpayers chose to cut or failed to fund the infrastructures needed to continue to provide services, and then woke up one day wondering why it was going to cost so much to make up the difference?

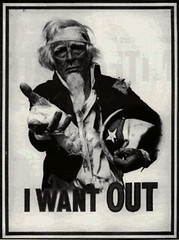

This kind of biased prole-baiting is exactly the reason the richest country in the world poor mouths every time a bridge needs fixed or a child needs medical care. And the fact that the real money continues to flow from the poorest to the richest never gets a mention, and if it does someone inevitably squeals "class war!!" That way, the working-class can be diverted from calling the ones responsible for this mess to account, and keep pretending they have more in common with Donald Trump than the clerical worker at a government office making $32K after 30 years on the job.