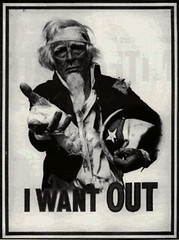

Oh, sweet Christ on a crutch, we're on our own, friends. Find a bucket and start bailing, because the poor are already treading water and going down for the third time, and the middle class just got the lifeboat with the hole in the bottom: (Elizabeth Warren via HuffPo)

WASHINGTON — President Obama on Thursday hosted a forum with scores of business and labor leaders and economic advisers to both political parties to field “every demonstrably good idea” for creating jobs, but he cautioned that “our resources are limited.”

...“I want to be clear: While I believe the government has a critical role in creating the conditions for economic growth, ultimately true economic recovery is only going to come from the private sector,” he told his audience, which included critics as well as executives from American Airlines, Nucor Corp., Google Inc., Walt Disney Co. and Fed-Ex.

Mr. Obama told the chief executives that he wanted to know: “What’s holding back business investment and how we can increase confidence and spur hiring? And if there are things that we’re doing here in Washington that are inhibiting you, then we want to know about it.”

Today, one in five Americans is unemployed, underemployed or just plain out of work. One in nine families can't make the minimum payment on their credit cards. One in eight mortgages is in default or foreclosure. One in eight Americans is on food stamps. More than 120,000 families are filing for bankruptcy every month. The economic crisis has wiped more than $5 trillion from pensions and savings, has left family balance sheets upside down, and threatens to put ten million homeowners out on the street.Warren goes on to note this cruel irony:

Families have survived the ups and downs of economic booms and busts for a long time, but the fall-behind during the busts has gotten worse while the surge-ahead during the booms has stalled out. In the boom of the 1960s, for example, median family income jumped by 33% (adjusted for inflation). But the boom of the 2000s resulted in an almost-imperceptible 1.6% increase for the typical family. While Wall Street executives and others who owned lots of stock celebrated how good the recovery was for them, middle class families were left empty-handed.

But core expenses kept going up. By the early 2000s, families were spending twice as much (adjusted for inflation) on mortgages than they did a generation ago -- for a house that was, on average, only ten percent bigger and 25 years older. They also had to pay twice as much to hang on to their health insurance.Warren's observations on the irony of being squeezed financially, despite the fact that the price of many goods have dropped sharply over the decades, is cited by Eileen Ruppell Shell in her book "Cheap". While Americans have been fed a continuing diet of cheap and inexpensive foods, entertainments, and household goods that has distracted them from their slipping wages, the so-called "inelastics", i.e., non-discountable essentials such as gasoline, health care, and housing, have gone up sharply. In times of high unemployment, this becomes a class-killer. How did our wages lose so much ground? Shell reminds us that the inflation of the 70s and de-regulation of the 80s spawned a nightmare of unemployment and credit debt, thanks to government policies (no link):

To cope, millions of families put a second parent into the workforce. But higher housing and medical costs combined with new expenses for child care, the costs of a second car to get to work and higher taxes combined to squeeze families even harder. Even with two incomes, they tightened their belts. Families today spend less than they did a generation ago on food, clothing, furniture, appliances, and other flexible purchases -- but it hasn't been enough to save them. Today's families have spent all their income, have spent all their savings, and have gone into debt to pay for college, to cover serious medical problems, and just to stay afloat a little while longer.

In 1978 the Humphrey-Hawkins Act mandated that inflation be reduced in 10 years from 9% to zero. The Federal Reserve Bank under both Paul Volcker and Alan Greenspan strove tirelessly to achieve this ambitious goal by controlling employment levels through the manipulation of interest rates. Volcker and Greenspan reasoned that too great a demand for workers would lead to an increase in wages, which both economists deemed inflationary. When the unemployment rate fell below 5.5 or 6%, or seemed headed in that direction, the Fed raised interest rates to inhibit economic growth and by extension, hiring. As a result of this strategy, the unemployment rate climbed to 9.6% in 1983...greatly enlarging the pool of people seeking work and substantially diminishing the power of most workers to demand an increase in wages and benefits. Wages flattened, and if workers wanted to buy more, they took out a loan, often in the form of credit card debt.And the rest, unfortunately, is history. All but the wealthiest fell into an earnings tar pit that we have yet to drag ourselves from. The predators at the top of the food chain have been eating us alive ever since.

Hear more about this from Warren herself in this Berkeley lecture from March 2007:

No comments:

Post a Comment