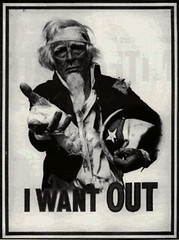

Coolie America Picks Up New Recruits

Coolie America Picks Up New RecruitsYou might have known. That plutocrat's brothel of a House of Representatives has consigned the minimum wage bill to public execution by tacking on an Estate Tax cut that will never be approved by the Senate. But just to rub it into the faces of the working poor, they also added a provision that would allow tips to be counted toward minimum wage increases in states where it is currently prohibited.

Now, this is a minimum wage that sat on the shelf at $5.15 hr. for 10 years, while the fat cats in the House and Senate got their repeated raises, with all the percs. Now, when boxed into a corner by shame and public pressure, the best they can come up with is an additional $2.10 hr. Imagine that you had received, in the last 10 years, a mere 21 cent a year raise after tips! And since they know even that miserly amount will fail to pass, yoked as it is to the Estate Tax in an election year, they know their real constinuency, the wealthiest 18 families in America, will continue to keep their campaign troughs full for years to come.

Housing Bubble Picks Up Steam

Michael Shedlock (Mish), at Mish's Global Economic Trend Analysis, reprints an Atlanta realtor's take on 2006 so far, and it isn't pleasant. From exuberant optimism fueled by a seeming continuity of strong sales in early January, "Sonnypage" tracks his business to the end of July, detailing the downward spiral of a market that suddenly just seemed to evaporate. Deals fall through, sellers who can't get their asking prices and can't afford to go low pull their houses off the market. Prices slide. He ends with this:

"What do you do if you owe more on your home than you can sell it for? Apparently, you just decide to sit on it and hope for a better market, at least for now."My husband, who sold cars for a brief period in the bad old days, called this "being upside-down": owing more on a vehicle than it was worth to re-sell. But seeing this in housing seems a fairly new phenomenon, and more common by the day. This is the heart of the housing problem: that ridiculous over-pricing has led both to pricing many averge-income buyers out of the market, and to a peak that cannot be sustained, that will inevitably fall, and leave behind it many home-owners who can't sell the place for what it cost them. Add to that (as Mish notes below) a house whose value to its owner has been seriously depleted by home equity borrowing, and you've got a recipe for a stagnant market at best, and at worst, a housing crisis of proportions unknown in living memory as rents rise, housing builds drop, and the entire economy dependent on housing and its peripherals crashes. But Mish lays it out best:

" * Home prices have outstripped wages by 4-5 standard deviations from normalVia Calculated Risk.

* Home prices have outstripped rents by 4-5 standard deviations from normal

...The "strong economy" was (and still remains) an illusion. What we had was an economy totally propped up by homebuilding and real estate transactions. 40% of all home buying in both 2004 and 2005 was for second homes or for "investments". In addition people were all too quick to spend that increased "wealth" from home price appreciation (and then some), going deeper and deeper in debt.

The economy has not crashed (yet) because homebuilders are still building. That supports jobs. But when those houses don't sell (and they won't - without enormous discounts) all this "paper wealth" of homeowners is going to vanish overnight. As soon as someone drops their price by $100,000 every house in the neighborhood will be repriced. Comps will drop like a rock. Consumers used to seeing nothing but rising prices are in for a rude awakening. Their house will no longer be an ATM. Consumer spending is 75% of the economy and it has only one way to go and that is down. There are going to be a lot of people hurt badly in the recession of 2007.

The Blame Game

It will be interesting to see who the scapegoats will be.

1. Some will blame Realtors

2. Some will blame the Fed for hiking rates too far

3. Some will blame the homebuilders for slashing prices

4. Some will blame their neighbors for selling too low

Where the blame really belongs:

1. On the Fed (not for raising rates) but for cutting them to 1% in the first place and flooding the world with dollars in the biggest liquidity experiment the world has ever seen

2. On banks and Fannie Mae for loose lending standards

3. On government for promoting the "ownership society"

4. On themselves for getting caught up in bubble madness just as they did with stocks in 2000, then taking cash out refis and spending like drunken fools further fueling a runaway economy

...A recession is just around the corner."

No comments:

Post a Comment